The Unspoken Link Between Air Pollution and Heart Disease in India

Air pollution isn’t just about smog and coughs — it’s quietly choking our hearts too. Here’s a raw, human take on the hidden connection between dirty air and heart disease in India.

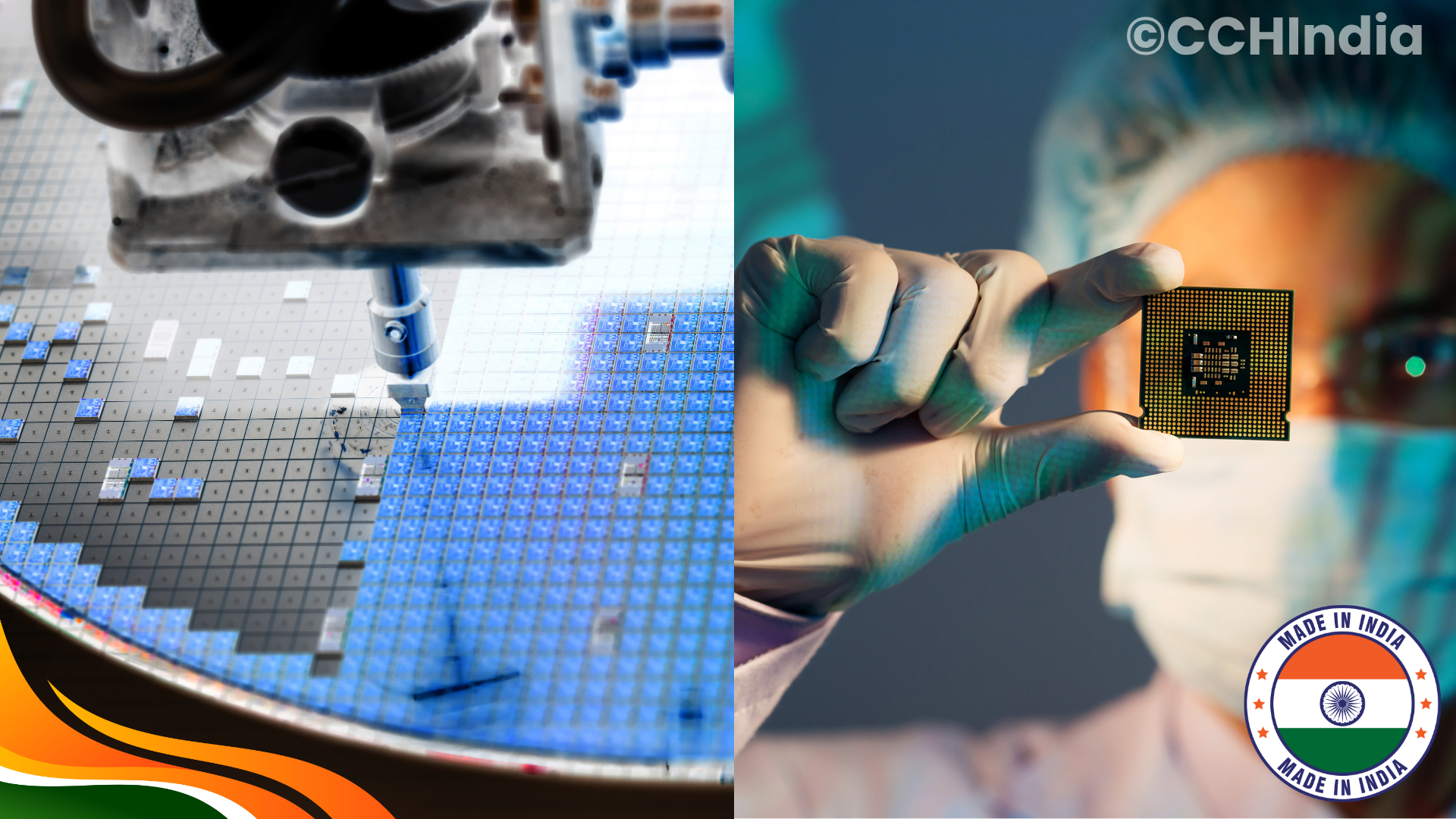

India is investing billions to become a global semiconductor powerhouse. But are government incentives building a full chip-making ecosystem or just temporary assembly hubs? Let’s explore the reality behind India’s chip dreams.

Table of contents [Show]

In the past few years, India has made headlines for its big leap into semiconductor manufacturing — a field long dominated by Taiwan, South Korea, and the U.S. With an ambitious $10-billion incentive program, the government wants to turn India into a global chip-making hub.

But the real question is — are we building a complete semiconductor ecosystem, or merely creating assembly and packaging hubs?

Chips are the new oil — powering everything from smartphones and electric cars to defense systems and satellites. The 2020 global chip shortage was a wake-up call for every nation, exposing how dependent the world had become on a handful of Asian manufacturers.

For India, the logic is simple: if we want to be self-reliant (Atmanirbhar Bharat), we need to make our own chips, not just design or import them.

The Semicon India Program, launched in 2021, offers:

Major players like Micron Technology, Tata Electronics, and Powerchip Semiconductor Manufacturing Corp. (PSMC) have already signed up. Micron’s Gujarat facility is expected to start producing memory modules by 2025 — a big symbolic win for India.

Here’s the tough truth — building a semiconductor fab is not like opening a car factory.

It needs:

While India is offering financial incentives, ecosystem development — from raw materials to logistics — still lags behind. Right now, most projects are assembly-focused, where imported wafers are packaged and tested locally.

This helps create jobs and builds experience, but it doesn’t necessarily lead to core manufacturing capability — where the real value lies.

Countries like Taiwan didn’t build TSMC overnight. It took decades of consistent policy, research investment, and global partnerships. The key wasn’t just funding but creating a full ecosystem — suppliers, engineers, universities, and R&D centers all working in sync.

India is still at an early stage of that journey. We’re laying foundations, but the ecosystem — from chip design to fabrication and testing — needs years of patient nurturing.

While fabs may take time, India already has an underrated advantage — chip design talent.

Over 20% of the world’s semiconductor design engineers are Indian, working at firms like Intel, Qualcomm, and NVIDIA.

If India can connect this design expertise with local fabrication, we can own both ends of the value chain — from ideation to production. That’s where true independence lies.

Experts argue that India must now move from “subsidy mode” to “infrastructure mode.”

That means:

In short, money brings investors, but infrastructure keeps them.

Without these essentials, India risks becoming just another assembly destination — not a true semiconductor nation.

It’s not all gloom, though. Even if India begins as an assembly and packaging hub, it’s still a crucial first step.

China, Malaysia, and Vietnam followed a similar route before upgrading to full-scale fabs.

The key is continuity — keeping policy stable for a decade or more, so investors know India means business.

India’s semiconductor push is one of its most ambitious industrial missions ever. The incentives are working to attract global players, but the challenge now is depth, not just headlines.

Building a chip ecosystem will take years of collaboration — between government, industry, and academia.

If India plays it right, today’s assembly hubs could evolve into tomorrow’s world-class fabrication centers.

For now, the dream is alive — but the silicon story has only just begun.

Air pollution isn’t just about smog and coughs — it’s quietly choking our hearts too. Here’s a raw, human take on the hidden connection between dirty air and heart disease in India.

India’s youth are not just the leaders of tomorrow but the change-makers of today. They will bring about the Vision of a Viksit Bharat

India, with its diverse culture, rich heritage, and a population exceeding a billion, stands as a testament to unity in diversity.

India’s vision for its 100th year of independence in 2047 is commonly known as “New India 2047,” “India@100,” or “Viksit Bharat 2047.”